Will Mortgage Rates Go Back Down in 2023? Unprecedented Surge to 7.09% Sparks Concern Among Prospective Homebuyers

Amidst a significant development in the housing market, with the thirty-year mortgage rate reaching 7.09% in early August, the highest level since 2002, the prevailing question remains: will mortgage rates go back down in 2023? This surge leaves experts divided on whether the trajectory will reverse as volatility persists in the market.

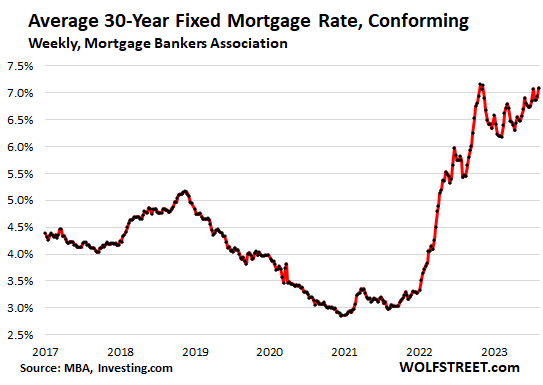

Graph depicting a substantial surge in mortgage rates during August 2023. The thirty-year mortgage rate has climbed to 7.09%, prompting contemplation on the question: ‘Will mortgage rates go back down in 2023? (PHOTO: Wolf Street)

“Will Mortgage Rates Go Back Down in 2023?”, Anxious Prospective Homebuyers Grapple as Thirty-Year Rate Surges to 7.09%

In a notable development for the housing market, the question “Will mortgage rates go back down in 2023?” is a topic of widespread concern as the thirty-year mortgage rate experienced a sharp increase to 7.09% in early August, as indicated by the Mortgage Bankers Association (MBA). According to CBS News, this rate, which stands as the highest level recorded, challenges prospective homebuyers who are left wondering about the future of mortgage rates. Factors in the increasing mortgage rates according to the MBA’s recent report, include:

- The Federal Reserve’s assertive sequence of interest rate hikes has precipitated increased costs across the following:

- Mortgages

- auto loans

- credit cards

- business borrowing.

The central bank’s recent elevation of the federal funds rate target to a range of 5.25% to 5.5% has once again spurred upward pressure on mortgage rates, raising the question of ‘Will mortgage rates go back down in 2023’.

- Fitch Ratings’ downgrade of U.S. debt from its highest rating has amplified the increase in mortgage rates.

- This has triggered a chain reaction, prompting the selling of bonds in panic, resulting in higher interest rates. This effect spreads through the mortgage market, creating uncertainty about the potential downward movement in 2023, as explained by Jacob Channel, LendingTree’s senior economist.

READ ALSO: BOSTON POSTAL CARRIER ROBBED AT GUNPOINT: ASSAILANT STEALS KEY TO USPS COLLECTION BOXES

“Will Mortgage Rates Go Back Down in 2023?” The Answer Remains Uncertain Amidst Economic Fluctuations

As industry experts weigh in on the future trajectory of mortgage rates, predictions surrounding the question “Will mortgage rates go back down in 2023?” point towards fluctuation rather than steadfast escalation.

- According to the reports, Channel emphasizes that while rates are prone to variation every week, they remain unstable, frequently showing ups and downs, which leaves potential homebuyers unsure about the question ‘Will mortgage rates go back down in 2023?’. While the possibility of rates dipping below the 7% threshold soon exists, they will probably stay relatively high around 6% to 7%, making potential homebuyers wonder if there will be any relief for those aiming to purchase homes in 2023.

- Despite the recent surges, analysts contend that the trajectory may not be an uninterrupted upward climb, offering a glimmer of hope for potential homebuyers who are hopeful for a decline in mortgage rates in 2023.

However, the mounting mortgage rates have initiated a cascade of consequences across the housing market. The Mortgage Credit Availability Index released by the MBA illuminates the tightening grip on lending standards, with credit availability declining by 0.3% in July. This tightening reflects lenders’ growing selectivity in choosing borrowers, with stringent criteria centered around higher incomes and improved credit scores. As a result, borrowers face elevated monthly payments, further heightening the barrier to homeownership and increasing the urgency of the question “Will mortgage rates go back down in 2023?”.

Pingback: Average Long-Term US Mortgage Rate Hits 6.96%, Matching 2023’s Peak: What You Need to Know! – texasredzonereport.com