Federal Reserve Anticipates Rate Hike Amidst Inflation Concerns and Internal Disagreements

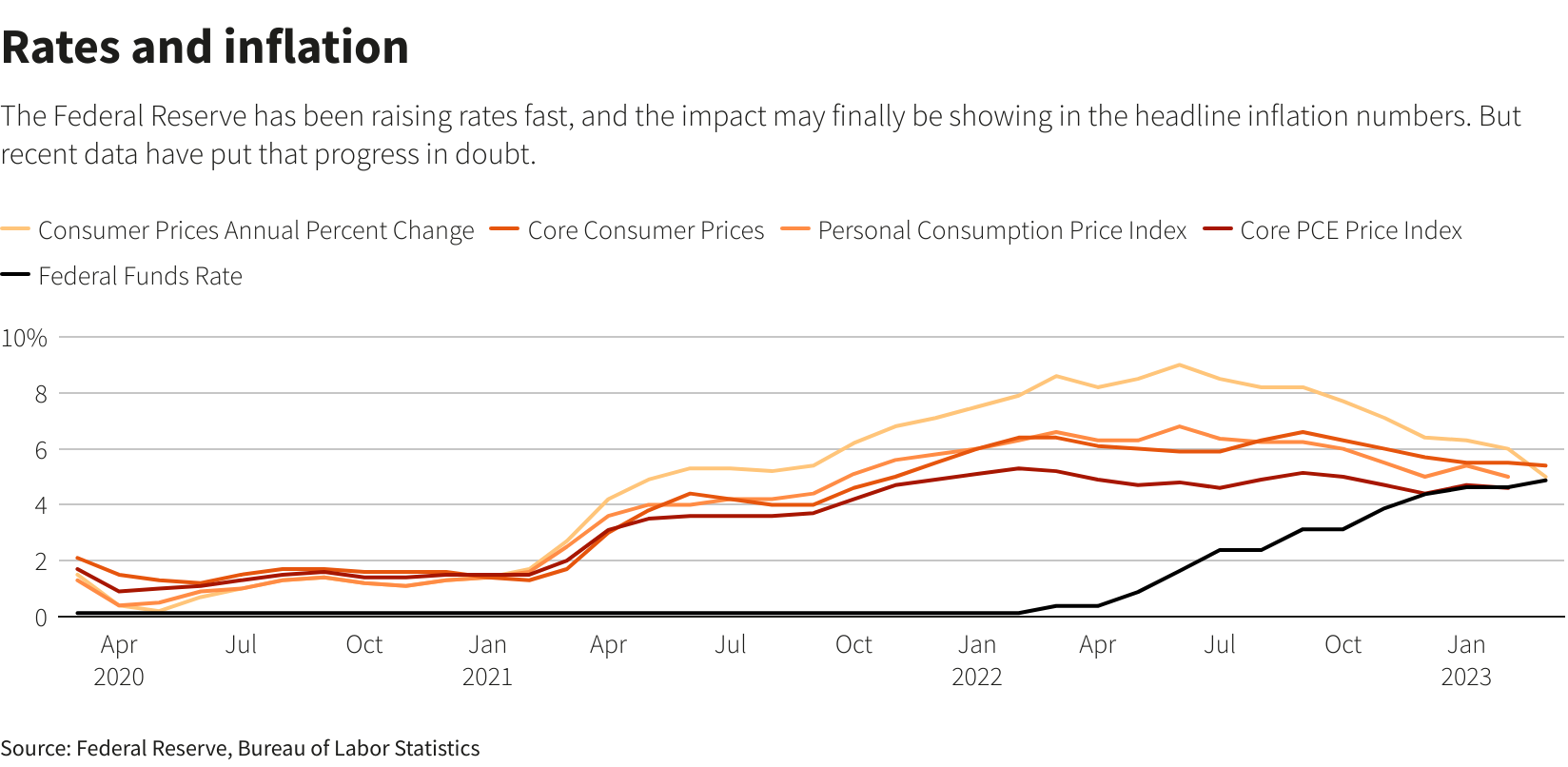

The Federal Reserve is expected to increase interest rates by a quarter percentage point despite slowing inflation, possibly the last hike for a while, leading to internal disagreements within the Fed board, while investors remain uncertain about future rate cuts.

Economists expect the Fed’s preferred inflation gauge, set to be released on Friday, to decline from 3.8% in May to 3% in June, bringing it close to the central bank’s 2% target rate. (PHOTO: The World Economic Forum)

READ ALSO: TWITTER REBRAND REVOLUTION: ELON MUSK’S BOLD MOVE TO ‘X’ THE BLUE BIRD!

Federal Reserve Nears Potential Final Rate Hike Amidst Uncertain Economic Landscape

The Federal Reserve remains steadfast in its approach and is not ready to give up just yet. Despite a brief pause last month, the central bank is widely anticipated to raise interest rates by a quarter percentage point tomorrow, even amidst signs of slowing inflation.

According to Bloomberg, this upcoming hike may very well be the last one for the foreseeable future. However, Fed Chair Jerome Powell is unlikely to divulge such information during the post-meeting news conference.

READ ALSO: PRICE HIKE ALERT: HOW RISING HOME PRICES IMPACT HOMEBUYERS IN 2023

Balancing Act for the Federal Reserve: Navigating Economic Strength Amidst Internal Disagreements and Investor Speculations

As reported in USA Today, key price indicators are showing improvement. Economists expect the Fed’s preferred inflation gauge, set to be released on Friday, to decline from 3.8% in May to 3% in June, bringing it close to the central bank’s 2% target rate. Moreover, the labor market remains robust, though experiencing a slight cooling trend, and consumer confidence has reached a two-year high. Home prices have also rebounded, adding strength to the economy. However, the challenge lies in ensuring this strength doesn’t reignite inflation or lead to a recession.

The diverse range of economic data presents a challenge for the Fed, as it may result in differing opinions within the board. After a prolonged consensus on the necessity of higher interest rates for over a year, disagreements are surfacing regarding when to halt rate hikes and how long to maintain elevated rates. As investors speculate that the central bank will begin lowering interest rates in the first half of the next year, it remains uncertain whether this prediction will prove accurate or merely a hopeful fantasy.

READ ALSO: INVESTORS BEWARE: SEAN TISSUE’S $3 MILLION FRAUD SCHEME LANDS HIM IN PRISON!